Alright, folks, gather ’round. So AAVE‘s doing a little dance—more like a belly flop than a graceful pirouette—dropping 23% since July. Yeah, the price is crashing like my hopes at a buffet, but the ecosystem? It’s doing cartwheels!

🎢 Готовы к крипто-американским горкам?

В Криптоклубе обсуждают всё: от туземуна до полного краха! 😓

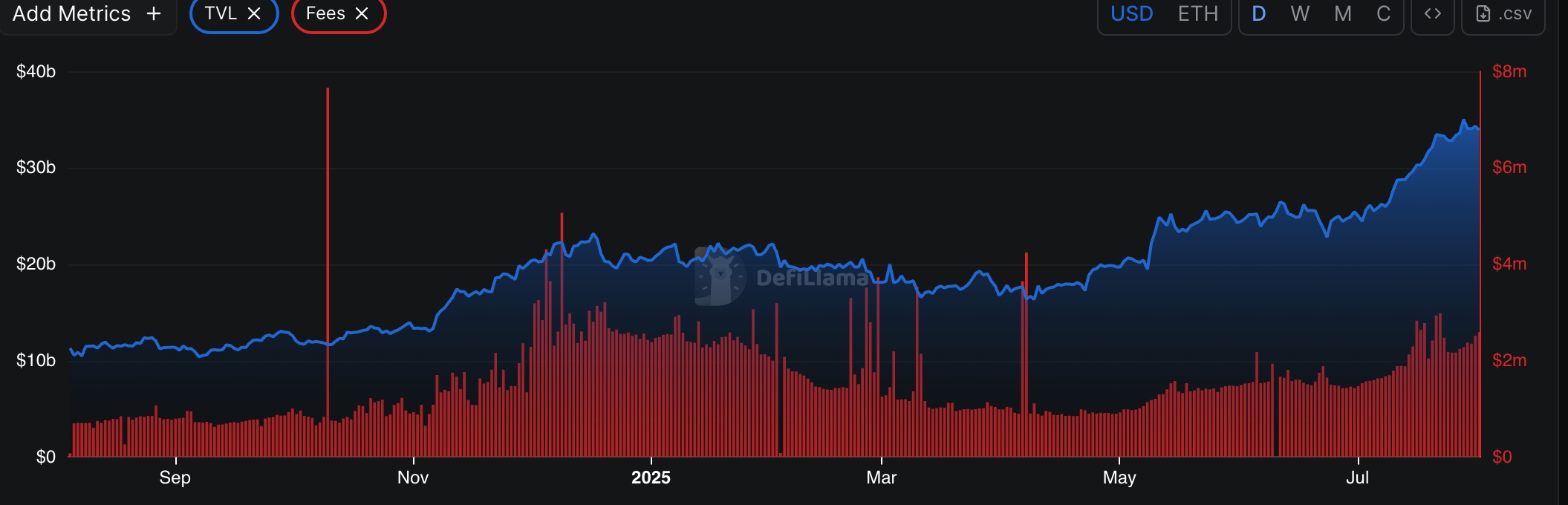

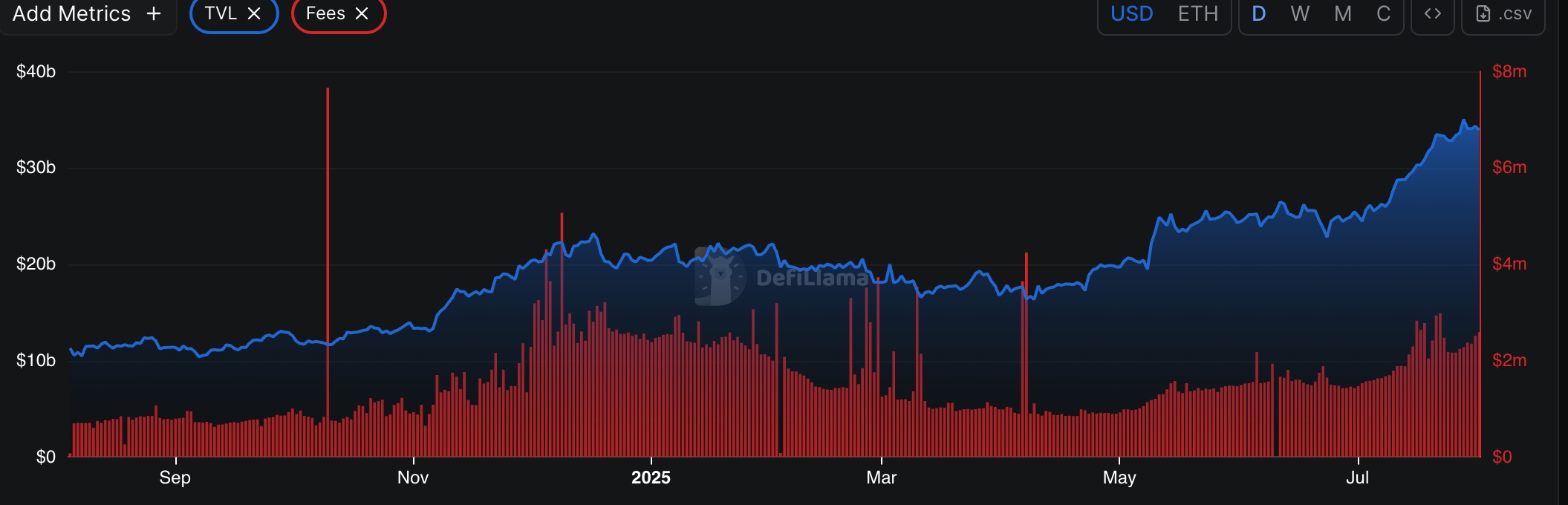

Now, hold onto your hats. Despite the slide, the total value locked is hitting a record—$35 billion! That’s more zeros than my bank account. Starting the year at $21 billion, so basically, they’re doing a magic trick—stuffing more assets into DeFi than I can hide snacks from my diet. And guess what? Ethena (ENA), the new kid on the block, just grew nearly $5 billion. That’s like putting a BOGO sale on digital assets.

Meanwhile, fees and revenue are skyrocketing. Over $783 million in fees in 12 months—that’s right, M-I-L-L-I-O-N. Their annual earnings? $47 million. Revenue? Over $110 million. I mean, if I could make that kind of cash without leaving my couch, I’d be doing handstands. Or at least a lazy wave.

TokenTerminal says deposits shot up 21% in July, active loans up by 25%—to a cool $20.5 billion. Monthly fees and revenue, like a rocket, up 49% and 85%. Basically, AAVE’s making bank, while its price is doing a «how low can you go» routine. The daily chart? A mess—peaked at $337.25, then took a nosedive faster than my New Year’s resolutions. It’s below the 50 and 100-day moving averages, lurking around the $250 line, like a kid hiding from chores. The RSI? Approaching «oversold,» so maybe it’s just tired or playing dead.

Слушай, если только ты не большой любитель страданий или у тебя есть инсайдерская информация, то это похоже на классический случай «купи дешево, может быть», а то и вовсе просто наблюдай со стороны и притворяйся, что понимаешь происходящее. Что бы ни случилось, это определенно интереснее, чем ежегодная рыбацкая байка моего дяди.

Смотрите также

- Анализ цен на криптовалюту ETH: прогнозы эфириума

- Анализ цен на криптовалюту BTC: прогнозы биткоина

- Анализ цен на криптовалюту SEI: прогнозы SEI

- Вырастет ли доллар? Почему этот прогноз курса к индонезийской рупии настораживает рынки

- Вырастет ли евро? Почему этот прогноз курса к рублю настораживает рынки

- Вырастет ли евро? Почему этот прогноз курса к гонконгскому доллару настораживает рынки

- Вырастет ли доллар? Почему этот прогноз курса к гривне настораживает рынки

- Вырастет ли доллар? Почему этот прогноз курса к шекелю настораживает рынки

- Анализ цен на криптовалюту SUI: прогнозы SUI

- Анализ цен на криптовалюту ALGO: прогнозы ALGO

2025-08-01 22:10